As the digital realm continues to evolve, the cryptocurrency market remains a dynamic landscape where investor sentiment, regulatory developments, and technological advancements intertwine to shape prices and trends. This week, a confluence of pivotal events has emerged, each casting its own shadow over the future of cryptocurrencies. At the forefront is Bitcoin, the king of cryptocurrencies, grappling with the psychological barrier that looms at $100,000—a milestone that not only represents a numerical value but also signifies a psychological stronghold for traders and investors alike. In this article, we will unpack three key events that are influencing crypto markets this week, examining how thay interplay with bitcoin’s quest for this ambitious threshold. Join us as we navigate the currents of market sentiment and explore the implications of these developments for the broader crypto ecosystem.

Market Sentiment Shifts as bitcoin Approaches the Landmark $100K

The cryptocurrency market is buzzing with a mix of excitement and apprehension as Bitcoin inches closer to the formidable $100,000 mark. This meaningful milestone has historically acted as a psychological barrier for traders and investors alike. Many analysts are closely monitoring the specific events that could catalyze or hinder bitcoin’s ascent beyond this key level. Among the driving forces behind current market sentiment are:

- Institutional Interest: A surge in institutional investments has reignited faith in Bitcoin’s long-term viability.

- Regulatory Developments: Recent announcements and policy frameworks from governing bodies are shaping investor confidence.

- Technological advancements: Updates and enhancements to blockchain technology are fueling optimism about Bitcoin’s scalability and usability.

Despite the optimistic trends, volatility remains a frequent companion in the crypto landscape. Traders are split on whether Bitcoin can maintain its momentum or if a correction is on the horizon. Market watchers are especially paying attention to the trading volumes and market depth as they indicate how strong the buying support is at this critical juncture. To visualize these elements, here’s a concise overview:

| Event | Impact on Market |

|---|---|

| Increased Institutional Buying | Heightened confidence and price support |

| New Regulatory framework | Perhaps smoother adoption and legitimacy |

| Blockchain Upgrades | improved functionality and user experience |

analyzing Regulatory Developments and Their Impact on Investor Confidence

Recent regulatory developments have cast a significant spotlight on the cryptocurrency landscape, leading to heightened scrutiny from investors. As governments and financial authorities worldwide move to implement stricter guidelines, market participants are faced with a dual-edged sword. While these regulations promise to enhance consumer protection and mitigate fraud risks, they simultaneously introduce uncertainty regarding the future of crypto assets. Investors are currently weighing the benefits of potentially safer trading environments against the fear of overreach and curbed innovation.

One notable example this week is the proposal of new tax regulations on cryptocurrency transactions in the United States. Although intended to create a transparent framework for tax purposes, the implications could discourage market participation, particularly among retail investors. The following factors are influencing investor confidence:

- Increased compliance burdens: Investors may perceive additional requirements as a barrier to entry.

- Potential for market fluctuations: Regulatory news can lead to uncertainty, causing volatility.

- Long-term viability: Clear guidelines could improve institutional confidence,paving the way for future investment.

| Event | Impact on Market |

|---|---|

| Regulatory framework proposal | Increased caution among investors |

| Tax regulations announcement | Possible decline in transaction volume |

| Government hearings | Investor uncertainty about future regulations |

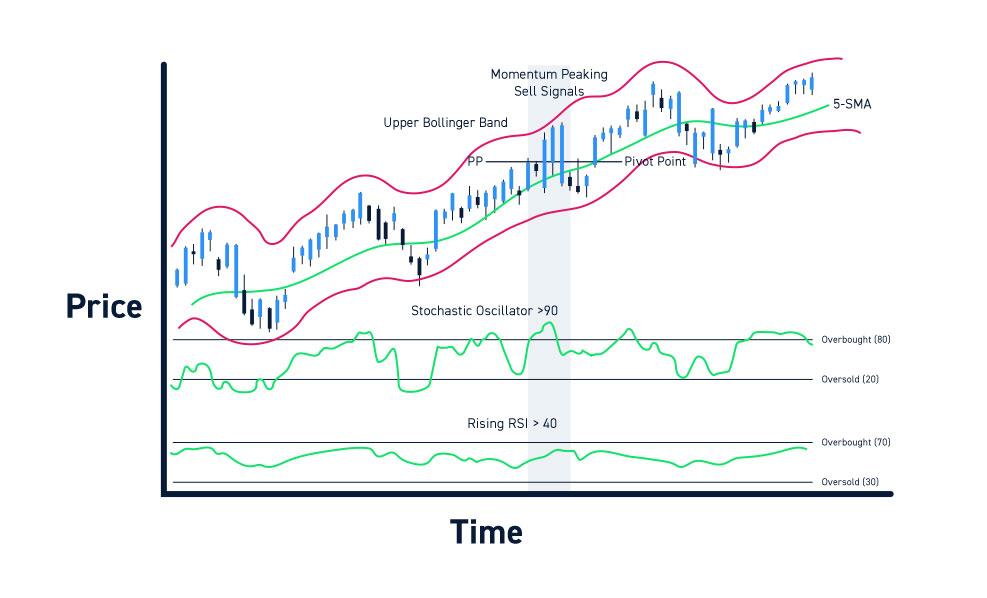

Technical Indicators Reveal Trading Strategies Amidst Market Volatility

As market volatility continues to shape the landscape of cryptocurrency trading, leveraging technical indicators has become essential for traders seeking to navigate these turbulent waters. Moving averages, for instance, serve as a essential tool to identify potential trend reversals, offering insights into support and resistance levels. Additionally, engaging with Relative Strength Index (RSI) can definitely help traders understand whether an asset is overbought or oversold, allowing for strategic entry and exit points. The convergence of these indicators can create a robust framework for formulating trading strategies even as emotions run high during significant market movements.

In the face of Bitcoin’s psychological barrier at the coveted $100K mark, traders may find it favorable to employ a combination of Bollinger Bands and Fibonacci retracement levels. These tools not only highlight price volatility but also delineate potential reversal zones that can signify ideal trading opportunities. Here’s a snapshot of some crucial technical indicators indicators to consider this week:

| Indicator | Purpose | Current Market Insight |

|---|---|---|

| Moving Averages | Identify trend direction | Indicates bullish sentiment approaching $100K |

| RSI | Determine overbought/oversold conditions | Currently nearing overbought territory |

| Bollinger Bands | Assess volatility | Price action nearing upper band suggests trading pressure |

Strategic Approaches for Navigating Potential Market corrections and Opportunities

In an habitat where market dynamics can shift rapidly, employing strategic methodologies is essential for both mitigating risks and exploiting emerging opportunities. Investors should consider adopting a diversified portfolio strategy to insulate against potential downturns. This might include allocations across various cryptocurrencies, as well as traditional assets, thereby reducing exposure to a single asset’s volatility.Another approach is to maintain an active risk assessment framework that enables timely re-evaluation of market conditions and positions. Constant vigilance around market trends and geopolitical influences can provide insights that inform rapid strategic pivots when necessary.

Moreover, educating oneself on market psychology can be an invaluable tool during periods of uncertainty. Understanding the behavioral economics that drive market sentiment around critical price points, like Bitcoin’s $100K psychological barrier, can inform wiser trading decisions. Establishing a buy-in-the-dip mentality while also recognizing overextension points for profit-taking can create points of competitive advantage. Additionally, employing technical analysis alongside fundamental research can lead to a well-rounded outlook that identifies not just immediate risks, but also the potential for long-term gains in an evolving cryptocurrency landscape.

Key Takeaways

As we wrap up our exploration of the three pivotal events shaping the crypto markets this week, it becomes evident that the intricate dance of market dynamics is ever-present. bitcoin’s ongoing struggle with the psychological barrier at $100K serves as a focal point, not just for traders, but for the broader financial landscape. The news of regulatory shifts and the infusion of institutional capital further underscore the multifaceted nature of this evolving ecosystem.

As we witness the tumultuous yet exciting intersection of innovation and speculation, it’s essential for investors to remain vigilant and informed. The week ahead promises more developments, and the crypto market will continue to reflect the ambitions, fears, and aspirations of its participants. Whether you’re a seasoned trader or a curious newcomer, every twist and turn adds a new chapter to this transformative story. Stay tuned, for in the world of cryptocurrency, the next big breakthrough could be just around the corner.